- Product Overview

- The method of use is simple!

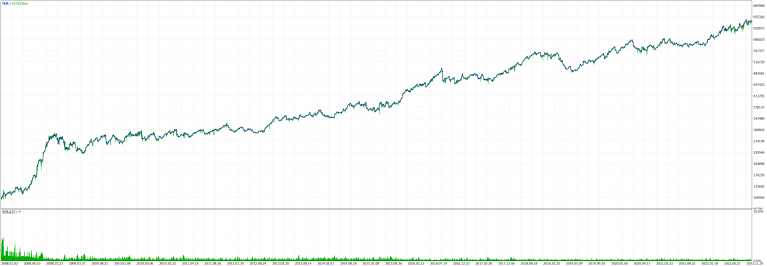

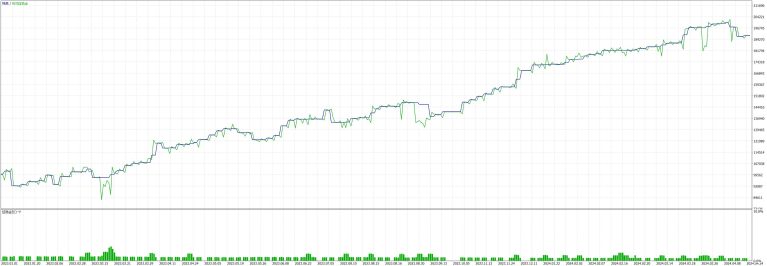

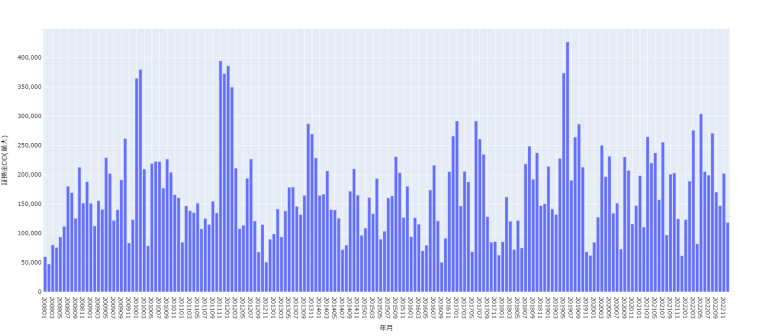

- Performance (backtest, simple interest)

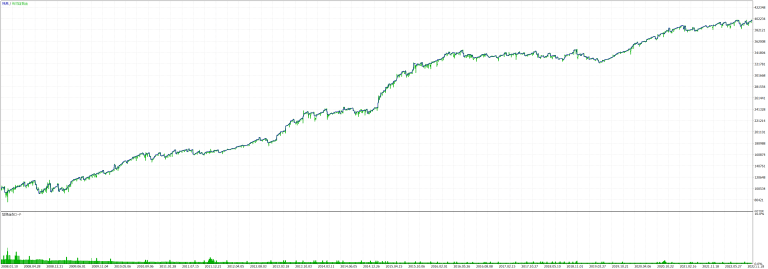

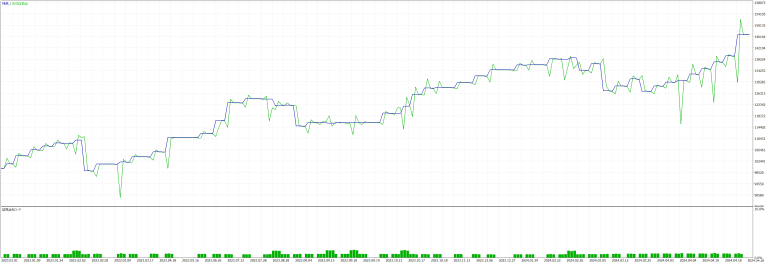

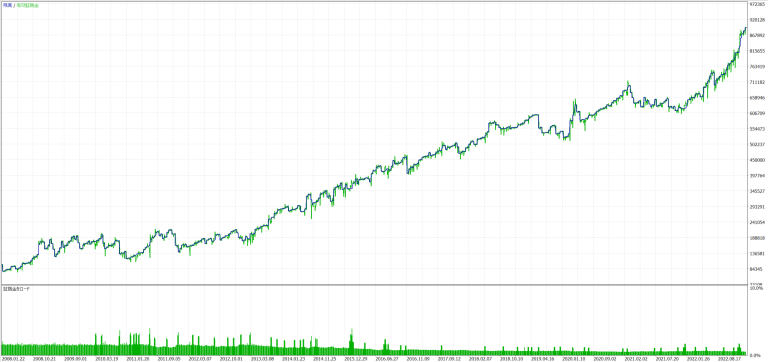

- Performance (forward test, simple interest)

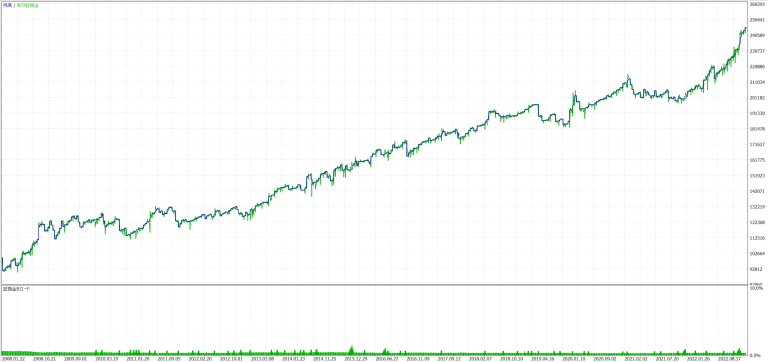

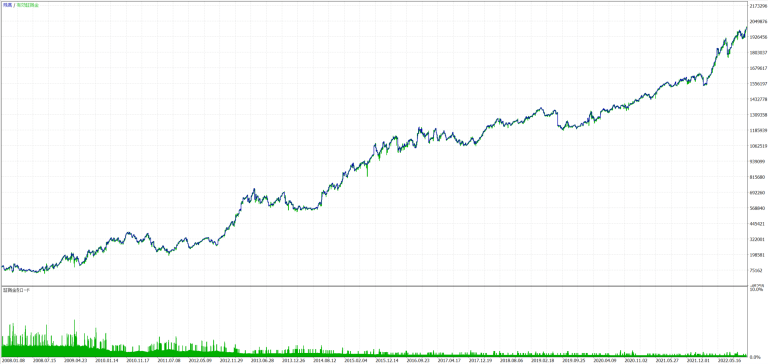

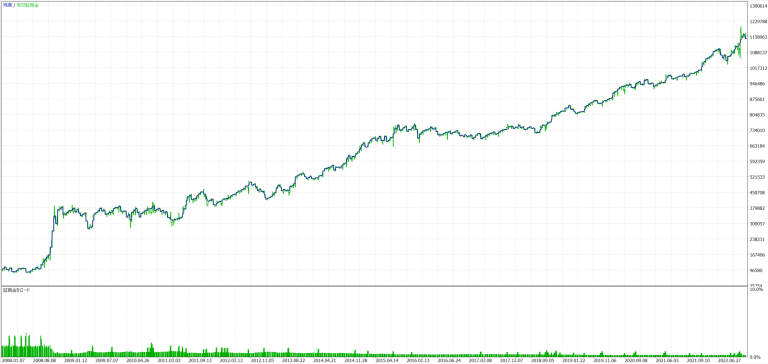

- Performance (back-tested and compounded)

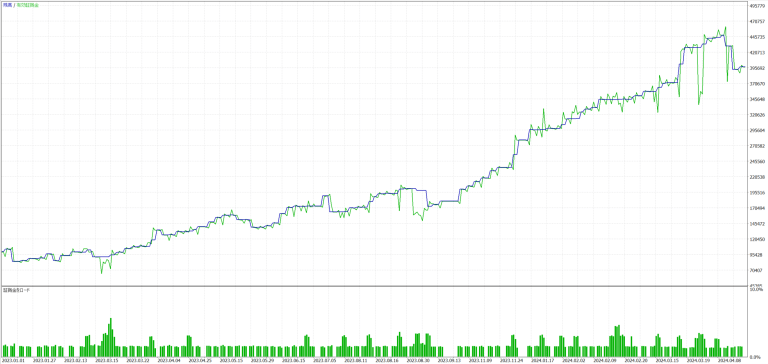

- Performance (forward test, compound interest)

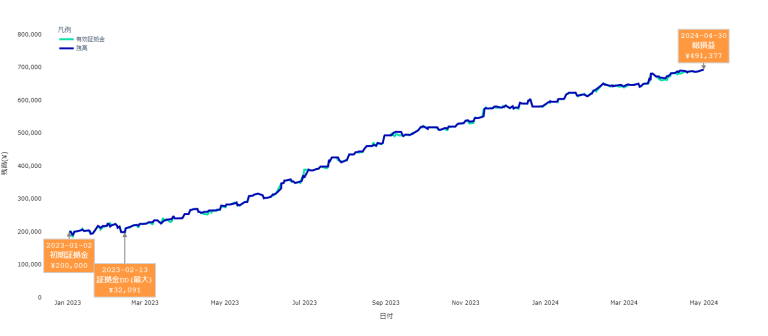

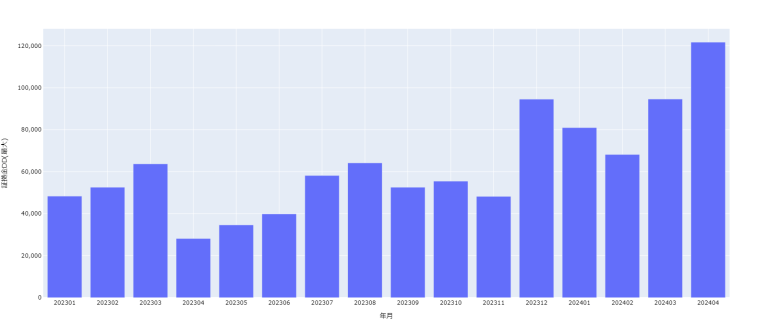

- Real forward results (compounded)

- operating environment

Product Overview

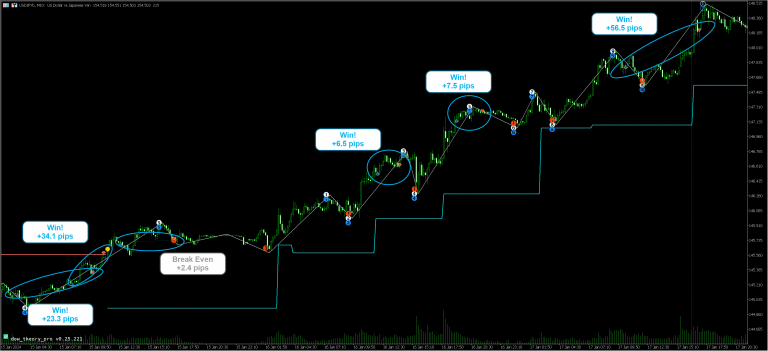

Sequential swing trade type EA based on Dow Theory

- The Dow Theory Indicator will make entries in the forward direction at points judged to be favorable for entry based mainly on trend direction judgment and waveform recognition for each of the long, medium, and short term trend indicators. This EA works well with stocks and time frames that tend to continue trends.

The image above shows the Dow Theory indicator superimposed on the EA's backtest results. The EA itself does not have the function to draw various lines and objects on the chart.

Machine learning is utilized to achieve a 75~80% win rate!

- Various indicators are used to evaluate the strength/weakness of trends and volatility, and these results are scored via machine learning to enable complex decisions that cannot be expressed using simple rules-based logic. This dynamically determined the market environment that was considered favorable for entry and raised the win rate.

Although there are variations from issue to issue, the back and forward test results show that the 9 issues covered by the release have a win rate of approximately 75~80%.

The back-test and forward-test results show that the 9 stocks in the release have a win rate of approximately 75~80%.

The back and forward test results are shown in the following table. - The machine learning behavior required a large number of parameters, and even the optimization of a single issue became extremely time-consuming.

Functional design with emphasis on stability!

Moderate number of entries

- Winning market conditions do not come often. Instead of forcing an entry, we carefully select favorable market conditions for entry.

- The back-test results show that even with 9 stocks operating simultaneously over 180 months, the number of trades was 7,406. The monthly average is about 4.5 times per stock, which is considerably less than that of a typical automated trading tool.

- While the number of entries is low, the highly versatile logic allows us to operate in multiple stocks, and we have tried to increase operational efficiency through portfolioization.

- No more than 1~2 simultaneous positions per stock will be held at the same time in most cases. No unplanned pick-and-pin to cover losses.

Automatic adjustment of stop-loss limits

- After a position is held, the stop loss is automatically adjusted in conjunction with a new low during a rising Dow trend (i.e., a new push low) or a new high during a falling trend (i.e., a new return high).

Trading style less sensitive to spreads and delivered rates

- Since it is not a scalping type of trading where the trader repeatedly targets narrow price ranges, the results do not fluctuate greatly due to slight differences in spreads or tick delivery rates.

Responding to the risk of sudden market changes

- It reads the economic indicator calendar and dynamically suppresses entries before the release of important indicators and adjusts stop-losses on open positions.

Can be operated from a small amount!

Funds management mode

- It can be operated in simple or compound interest mode.

- For compounding mode, a fixed margin method is used. This method dynamically manages the number of lots according to the surplus margin, leverage, and risk % of the starting parameters. Since the lot size is dynamically controlled taking into account the amount of funds and the state of unrealized losses/gains, it is not only easy to increase profits when winning in a row, but it is also expected to reduce the amount of losses when losing in a row.

portfolioing

- The EA is optimized based on the rate characteristics of each stock/time frame/trading direction. Diversification of stocks and time frames improves overall stability and operational efficiency.

- Although the frequency of trading per EA is much more modest than that of general automated trading tools, the versatile logic that can be adapted to a wide range of stocks ensures many trading opportunities by operating with multiple stocks.

release notes

| Date | Contents |

| 2024/04/30 | v1.0 Add new issue

|

| 2024/04/16 | v1.0 released

|

The method of use is simple!

At startup.

You can start trading immediately by adjusting the money management mode (simple or compound interest) and the number of lots.

The initial parameters are pre-optimized and embedded for each issue, so that you can start using the system without having to perform difficult tasks such as analyzing and optimizing the parameters by yourself.

The total number of parameters is about 150 as a result of mimicking the computational process of machine learning in the development of EA, and it is not realistic for a human to set each parameter individually in his/her head.

Parameters that do not significantly degrade generalization performance are adopted after optimization for each stock and sufficient forward test evaluation to avoid over-learning.

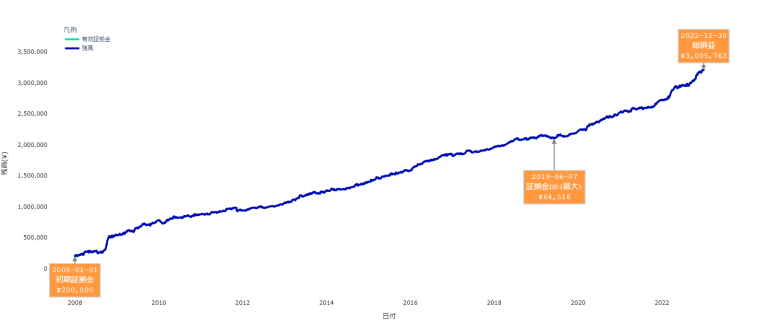

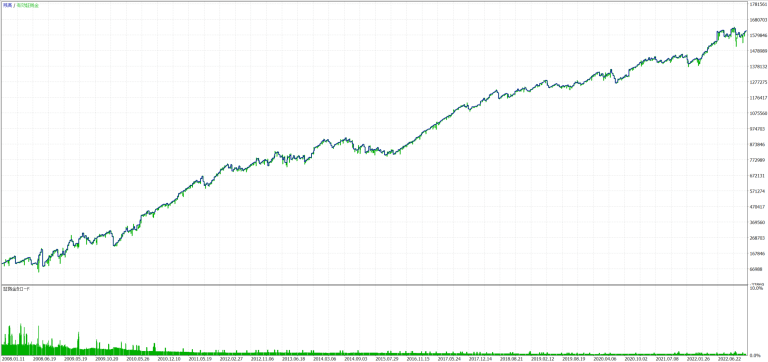

Performance (backtest, simple interest)

test conditions

- Test period 15 years (2008/01/01~2022/12/31)

- Initial margin 100,000 yen (Initial margin is set at 200,000 yen only for the combined results of all issues)

summary

| Outstanding Balance | Monthly Drawdown Trends |

|  |

description | total profits or losses | Margin Maximum DD | PF (Profit Factor) | RF (Recovery Factor) | SR (Sharpe Ratio) |

| USDJPY | 347,993 yen | 31,524 yen | 1.37 | 11.04 | 1.66 |

| GBPJPY | 556,236 yen | 56,061 yen | 1.48 | 9.92 | 1.58 |

| GBPUSD | 538,765 yen | 65,199 yen | 1.33 | 8.26 | 1.70 |

| USA100 | 443,605 yen | 44,090 yen | 1.84 | 10.06 | 3.15 |

| AUDJPY | 258,222 yen | 21,368 yen | 1.70 | 12.08 | 2.74 |

| EURNZD | 298,766 yen | 29,340 yen | 1.71 | 10.18 | 1.78 |

| XAUUSD | 234,842 yen | 28,375 yen | 1.65 | 8.28 | 3.20 |

| AUDUSD | 182,072 yen | 18,743 yen | 1.78 | 9.71 | 3.82 |

| USDCHF | 145,373 yen | 18,511 yen | 1.63 | 7.85 | 2.67 |

Test Results by Brand Name

| description | Outstanding Balance | Test Results |

| USDJPY |  |  |

| GBPJPY |  |  |

| GBPUSD |  |  |

| USA100 |  |  |

| AUDJPY |  |  |

| EURNZD |  |  |

| XAUUSD |  |  |

| AUDUSD |  |  |

| USDCHF |  |  |

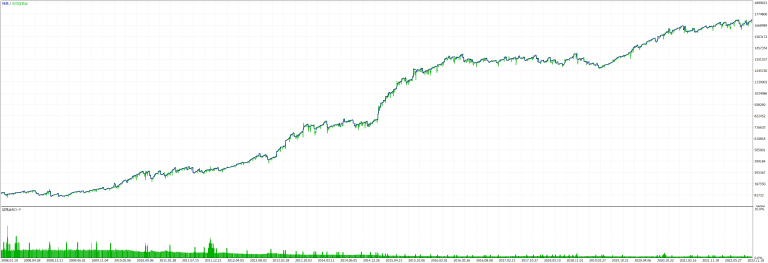

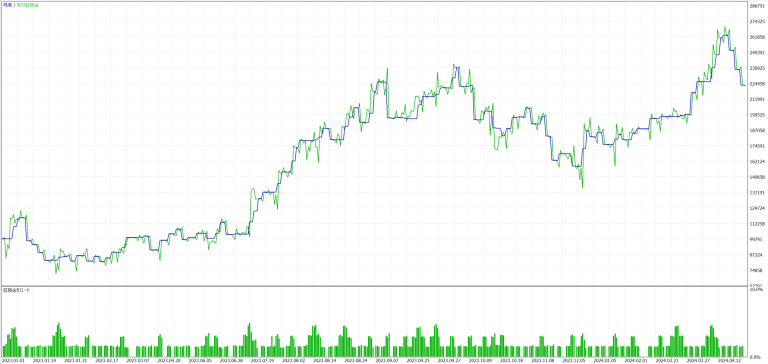

Performance (forward test, simple interest)

test conditions

- Test period 1 year and 4 months (2023/01/01~2024/04/30)

- Initial margin 100,000 yen

summary

| Balance (total of all issues) | Monthly Drawdown Trends (Total of All Issues) |

|  |

description | total profits or losses | Margin Maximum DD | PF (Profit Factor) | RF (Recovery Factor) | SR (Sharpe Ratio) |

| USDJPY | 42,076 yen | 22,986 yen | 1.43 | 1.83 | 2.45 |

| GBPJPY | 91,730 yen | 21,718 yen | 2.51 | 4.22 | 4.70 |

| GBPUSD | 61,840 yen | 30,348 yen | 1.54 | 2.04 | 2.84 |

| USA100 | 215,290 yen | 29,379 yen | 2.64 | 7.33 | 6.93 |

| AUDJPY | 7,449 yen | 24,177 yen | 1.18 | 0.31 | 1.27 |

| EURNZD | 31,213 yen | 17,900 yen | 2.30 | 1.74 | 3.20 |

| XAUUSD | 46,818 yen | 23,748 yen | 2.09 | 1.97 | 4.77 |

| AUDUSD | 15,158 yen | 13,596 yen | 1.55 | 1.11 | 4.08 |

| USDCHF | 11,016 yen | 13,552 yen | 1.58 | 0.81 | 3.36 |

Test Results by Brand Name

| description | Outstanding Balance | Test Results |

| USDJPY |  |  |

| GBPJPY |  |  |

| GBPUSD |  |  |

| USA100 |  |  |

| AUDJPY |  |  |

| EURNZD |  |  |

| XAUUSD |  |  |

| AUDUSD |  |  |

| USDCHF |  |  |

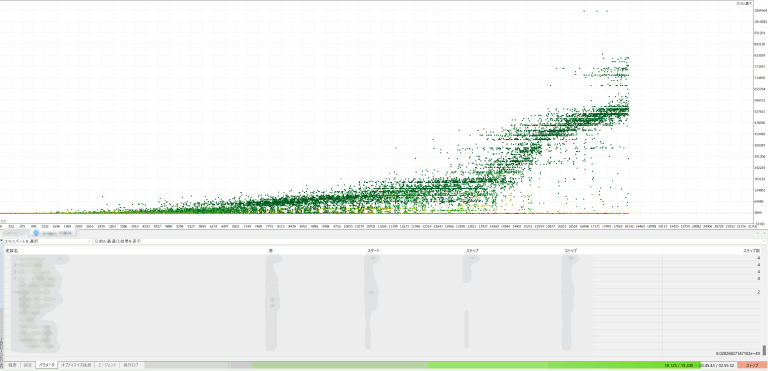

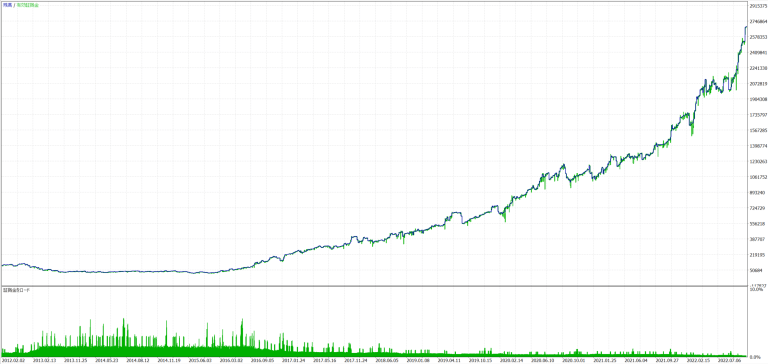

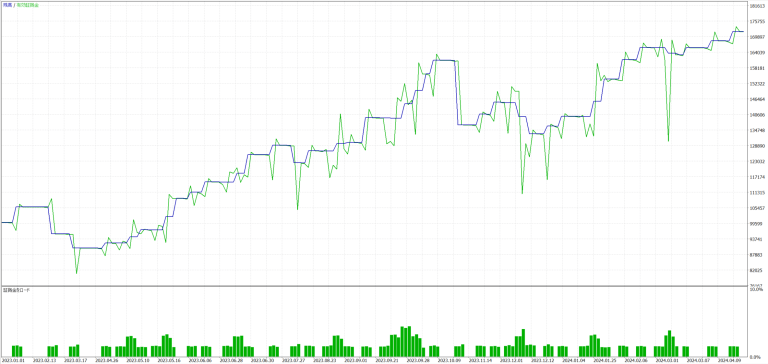

Performance (back-tested and compounded)

test conditions

- Test period 1 year and 4 months (2023/01/01~2024/04/30)

- Initial margin 100,000 yen

- Compounding mode (fixed margin 1.5%, with maximum lot size)

summary

| Balance (total of all issues) | Monthly Drawdown Trends (Total of All Issues) |

|  |

description | total profits or losses | Margin Maximum DD | PF (Profit Factor) | RF (Recovery Factor) | SR (Sharpe Ratio) |

| USDJPY | 1,763,614 yen | 180,275 yen | 1.34 | 9.78 | 1.01 |

| GBPJPY | 3,349,921 yen | 231,896 yen | 1.54 | 14.45 | 1.75 |

| GBPUSD | 2,761,770 yen | 335,219 yen | 1.29 | 8.24 | 1.70 |

| USA100 | 2,505,205 yen | 206,783 yen | 1.95 | 12.12 | 1.70 |

| AUDJPY | 1,304,283 yen | 128,209 yen | 1.66 | 10.17 | 1.64 |

| EURNZD | 1,615,443 yen | 151,900 yen | 1.73 | 10.63 | 1.54 |

| XAUUSD | 2,252,037 yen | 284,625 yen | 1.66 | 7.91 | 2.90 |

| AUDUSD | 1,156,920 yen | 96,814 yen | 1.94 | 11.95 | 4.39 |

| USDCHF | 765,441 yen | 108,891 yen | 1.58 | 7.03 | 1.95 |

Test Results by Brand Name

| description | Outstanding Balance | Test Results |

| USDJPY |  |  |

| GBPJPY |  |  |

| GBPUSD |  |  |

| USA100 |  |  |

| AUDJPY |  |  |

| EURNZD |  |  |

| XAUUSD |  |  |

| AUDUSD |  |  |

| USDCHF |  |  |

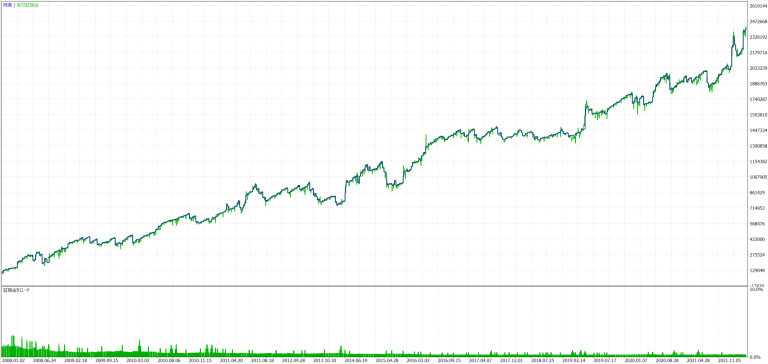

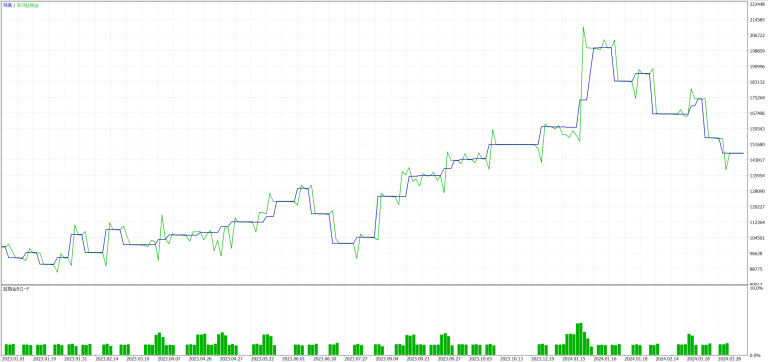

Performance (forward test, compound interest)

test conditions

- Test period 1 year and 4 months (2023/01/01~2024/04/30)

- Initial margin 100,000 yen

- Compounding mode (fixed margin 1.5%, with maximum lot size)

summary

| Balance (total of all issues) | Monthly Drawdown Trends (Total of All Issues) |

|  |

description | total profits or losses | Margin Maximum DD | PF (Profit Factor) | RF (Recovery Factor) | SR (Sharpe Ratio) |

| USDJPY | 109,130 yen | 95,892 yen | 1.35 | 1.14 | 2.08 |

| GBPJPY | 317,885 yen | 97,514 yen | 3.13 | 3.26 | 4.70 |

| GBPUSD | 108,229 yen | 79,168 yen | 1.46 | 1.37 | 2.25 |

| USA100 | 216,139 yen | 49,468 yen | 2.32 | 4.37 | 6.52 |

| AUDJPY | 22,099 yen | 63,751 yen | 1.16 | 0.35 | 1.44 |

| EURNZD | 71,834 yen | 52,561 yen | 2.14 | 1.37 | 2.81 |

| XAUUSD | 72,986 yen | 65,959 yen | 1.64 | 1.11 | 3.93 |

| AUDUSD | 35,997 yen | 68,093 yen | 1.30 | 0.53 | 2.65 |

| USDCHF | 18,547 yen | 34,555 yen | 1.38 | 0.54 | 2.36 |

Test Results by Brand Name

| description | Outstanding Balance | Test Results |

| USDJPY |  |  |

| GBPJPY |  |  |

| GBPUSD |  |  |

| USA100 |  |  |

| AUDJPY |  |  |

| EURNZD |  |  |

| XAUUSD |  |  |

| AUDUSD |  |  |

| USDCHF |  |  |

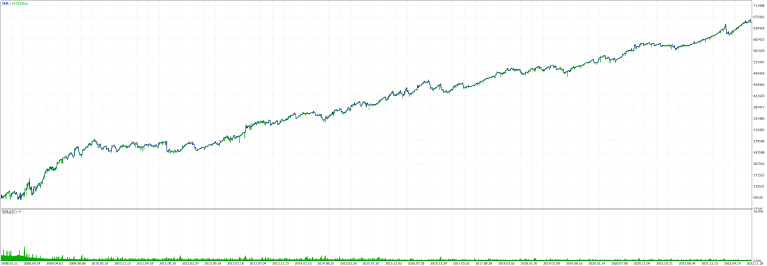

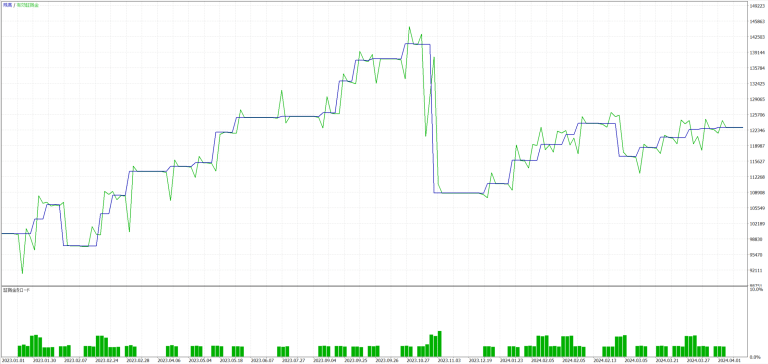

Real forward results (compounded)

2024/04/16 Operation started!

operating environment

platform

MT5 (MetaTrader5)

Brokerage - Account Type

As for free distribution, the following accounts are available

- HFM - Premium

- XM - Standard

*Distribution for other account types is currently under consideration. Please understand that we are not in a position to do so.

Account Currency

Tested in JPY or USD

target issue

Optimization was performed for each of the following issues, taking into account rate characteristics.

- USDJPY

- GBPJPY

- GBPUSD

- USA100

- AUDJPY

- XAUUSD

- AUDUSD

- USDCHF

- EURNZD

time limit

5min~20min *Optimization was performed for each issue.

EAは無料でご利用頂けます!

利用方法1: HFコピーを使用してVPS不要でトレードする

の概要と利用方法は以下の記事をご参照ください。

利用方法2:VPSを用意してEAを配置する

手順1.MT5の口座を作成する

無料EAはHFM(Premium口座)、 または XM(Standard口座)でご利用頂けます。

以下リンクから口座開設をお願いいたします。

※条件次第では、低スプレッド口座でご利用頂くこともできます。 詳しくはご相談ください。

※既にHFMのアカウントを作成済の場合は・・・

口座を追加開設し、「イントロデューシングブローカーIDまたはキャンペーンID」

という入力欄に 340746 とご入力ください。

手順2.自動売買ツール利用申込

以下のような画面が開きますので、必要事項をご入力の上、お問い合わせください。

送信ボタンを押すと、ご入力頂いたメールアドレス宛に以下の自動返信メールが届きます。

※もし届かない場合はアドレスの入力間違いか、迷惑メールに届いている可能性があります。 迷惑メールを確認しても届いていない場合は、

お手数ですがメールアドレスを再度ご確認頂き、改めてお問い合わせください。

手順3.VPSを契約する

既にVPS環境を持っている方は、そのままそちらをご使用頂けます。

新たにVPS環境を作る場合はいくつか手段がありますが、ご自身でVPSを構築することに抵抗がある方(難しそう・管理をどうしたら良いか分からないと感じる方)は、VPSサービスを活用することをおすすめします。

【#PR】

MT5を使うなら、海外の証券会社がオススメ!

国内証券会社は追証リスクある上に、ほとんどの証券会社でMT5を利用することができません。

入金額以上のリスクを負わずに済むゼロカット制度が適用されるのは海外証券会社のみとなります。

ただし、どこの証券会社でも良いという訳ではありません。

メジャーな海外証券会社を選択することで、

- 低スプレッド環境でトレードが出来る

- トレードの遅延が少なく品質が安定している

- 入金ボーナスで、少額からトレード可能

- 入出金トラブルがない

等、多くのメリットを享受できます。 MT5を使う際は、同時に海外証券会社での口座開設もご検討ください。

EA利用者限定の特典あり!

EAをリアル口座で活用頂いている方への特典として、独自開発したインジケーターを無料でご利用いただけます。

自動売買ツールを活用すればトレードそのものはプログラムが規則に従い継続的に行うことができますが、どのEAを、いつ起動/停止するのかを判断するのは人間の役割となります。

相場環境の分析が必要になることもありますので、是非これらの無料インジケーターを使用して堅実な投資の実現にお役立てください。