![MT5 Usage Guide [A must-read for beginners] Thorough comparison of recommended FX brokerages!](https://i0.wp.com/smart-trading-strategy.com/wp-content/uploads/2023/12/2023-12-06-22.25.28.jpg?fit=1792%2C1024&ssl=1)

MetaTrader 5 (MT5 ) is a powerful tool for individual investors to make their trading more effective. With the goal of enabling even beginners to easily utilize MT5, this guide explains how to start using the tool and how to perform basic operations.

Contents

Why do I need a brokerage firm to trade FX?

Many beginners may wonder, "I want to start using MT5, but why do I need a brokerage firm, and can't I just use MT5 to analyze the markets and trade?" Many beginners may wonder, "Why do I need a brokerage firm?

It may seem like a hassle, but a trial only requires no personal funds and the process is easy. Let's proceed with confidence.

Why do I need a brokerage firm?

Brokerage firms are the "intermediaries" between investors and the financial markets. At first glance, it may appear that investors themselves are directly placing buy and sell orders to the financial markets, but this is not the case.

The rough image is

- The investor places an order with the brokerage firm, which executes the actual trade against the financial market.

- Rates provided by the financial markets are distributed to MT5 through brokerage firms, and individual investors make buying and selling decisions based on the rates on MT5.

Can I use any brokerage firm?

There are good and bad brokerage firms, and choosing the right one is very important.

- Reliability and security.

- To keep costs down and make it easy to increase profits.

to make a variety of evaluations to determine the good and the bad.

How to choose a brokerage firm

Domestic vs. foreign vendors

If selected according to the appropriate criteria

International brokerage firms offer greater advantages to beginners

........

It is advisable to familiarize yourself with the environment at a low-risk overseas brokerage firm, and then make a better choice based on your own capital volume and trading style.

Strictly speaking, each brokerage firm has its own rules and regulations, but here are some general trends to start with

| Securities Companies | Securities companies in Japan | |

| risk | Zero-cut system available

|

No zero-cut system

|

| Support | Full Japanese-language support

|

Japanese Language Support

|

| Security of funds | Major brokerage firms follow proper money management rules.

|

Compliance with strict FSA regulations

|

| taxation system | tax on aggregate income

|

separate declaration taxation

|

| MT5 support | Almost all MT5 compatible

|

Most vendors that do not support MT5

|

The zero-cut system is a particularly powerful service. Will it be a strong ally for beginners, as they will never lose more than the amount deposited with the brokerage firm?

Choose a vendor with low costs.

Transaction costs

| cost | summary |

| Transaction fees |

|

| spread |

|

| Swap (interest rate differential) |

|

In order to make a deal with a favorable article ticket

- Zero transaction fees

- Narrow Spreads

- swap-free

It is desirable to have a brokerage firm that meets the following conditions

However, in the case of zero transaction fees, the alternative may be a wide spread, so it is important to consider all three factors and select a firm with low costs.

leverage

If you are planning to invest a small amount, you can start trading with a small amount of money by choosing a brokerage firm that allows high leverage.

They say, "High leverage is risky."

With a zero-cut system + small investment, high leverage is only beneficial!

The following is a brief overview of the benefits of high leverage.

Make good use of it depending on the situation.

Other Costs

Deposit and Withdrawal Fees

There are fees charged for deposits and withdrawals to and from brokerage firms. For overseas brokerage firms, an overseas remittance is required to deposit funds, which incurs a fee.

It is not a frequent occurrence, but the larger the amount transferred, the larger the fee. Look for a deposit/withdrawal method with low fees.

Labor for daily information gathering

Gathering market information and regularly checking rate trends are also important tasks for continued profitability.

While it is useful to search news sites for this information yourself, you should also make effective use of seminars and news provided by securities firms.

Support

The first time you deal with account opening procedures, daily trading, and handling profit withdrawals, you may feel anxious.

When dealing with brokerage firms, reliable customer support is a big relief.

- Japanese language support

- Prompt reply

- Consistent and consistent answers

Another important factor is whether or not there is a well-developed Japanese-language support desk, such as

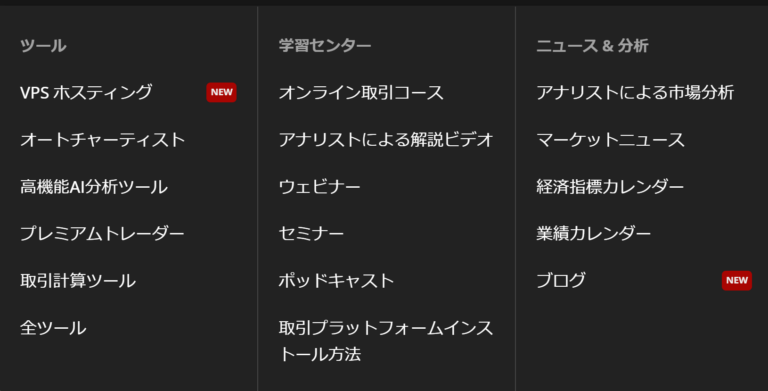

Educational Resources

Some brokerage firms offer market analysis tutorials, trading strategies, and market opening seminars.

Since useful information can often be obtained, we encourage you to take advantage of any services offered.

Trade Support Tools

Some brokerage firms may offer advanced charting tools, analysis tools, trading server environments, etc.

Some services are provided free of charge, while others are provided free of charge if certain conditions are met.

These should also be utilized if the needs match.

Which brokerage firm do you recommend?

Brokerage Comparison

The following table compares the major international brokerage firms on several key metrics.

First, we summarized and evaluated all account types to get a general trend of brokerage firms.

fa-bank

Brokerage Comparison

| XM | HFM | Exness | AXIORY | Tradeview | ||

| plat form |

automatic buying and selling |   |

|

|

|

|

| Copy account | nashi (Pyrus pyrifolia, esp. var. culta) | ant | nashi (Pyrus pyrifolia, esp. var. culta) | nashi (Pyrus pyrifolia, esp. var. culta) | nashi (Pyrus pyrifolia, esp. var. culta) | |

| terms and conditions (e.g. of a purchase or trade) | spread | |||||

| commission | ||||||

| swap-free | KIWAMI Pole | Premium, Pro, Zero, Cent. | Pro, Low Spread, Zero, Standard, Standard Cent. | nashi (Pyrus pyrifolia, esp. var. culta) | nashi (Pyrus pyrifolia, esp. var. culta) | |

| leverage | Up to 1,000 times | Up to 2,000 times | Up to 2,000 times | Up to 1,000 times | Up to 500 times | |

| Deposit Bonus | ant | ant | nashi (Pyrus pyrifolia, esp. var. culta) | ant | nashi (Pyrus pyrifolia, esp. var. culta) | |

| building on two sides of the same building | Possible (in the same account) | Possible (in the same account) | possible | possible | possible | |

| scalping | possible | possible | possible | possible | possible | |

| Tool Provision |

Free VPS | ant | ant | ant | nashi (Pyrus pyrifolia, esp. var. culta) | nashi (Pyrus pyrifolia, esp. var. culta) |

| Trade Tools | nashi (Pyrus pyrifolia, esp. var. culta) | Autochartist, etc. | Analysis tools, etc. | Autochartist, etc. | nashi (Pyrus pyrifolia, esp. var. culta) | |

| safety | Financial License | Two permits/regulations | 6 permits and regulations | 8 permits and regulations | Two permits/regulations | 1 permit/regulation |

| cash management | separation of duties | separation of duties | separation of duties | separation of duties | separation of duties | |

| Support | Japanese Language Support | |||||

| evaluation | word-of-mouth website (FPA ) (as of 2023/12) |

3.1(686 review) | 3.7 (549 reviews) | 3.1 (541 reviews) | 3.3(36 reviews) | 4.1 (139 reviews) |

| Other | Corporate Account | nashi (Pyrus pyrifolia, esp. var. culta) | ant | ant | ant | ant |

*Each brokerage firm has multiple account types, and the conditions for detailed services differ depending on the account type. We recommend that you reconfirm the terms and conditions provided by the brokerage firm and account type you will actually use.

HFM is recommended for beginners!

HFM (formerly HotForex) is recommended for beginners to intermediate traders.

Although we have the impression that the company is not as well known in Japan as other companies, the services it offers are very extensive.

Generous Japanese-language support

Although each company claims to provide support services in Japanese, the quality of the answers varies considerably.

Japanese people have become accustomed to excessive service, and the quality of support for overseas services is

- It takes time to answer.

- The answers are off the mark.

- Contents are thin and unclear points cannot be resolved

- Dry to deal with

There are many cases of dissatisfaction, such as

This evaluation was based on the responses (speed of response and accuracy of content) when the author actually made inquiries in Japanese to the five companies.

The result,

HFM provided the best customer support.

HFM provided the best customer support and the level of service that the Japanese are accustomed to.

Competitive trading conditions

There is no definite difference between the companies in terms of transaction fees, which are the sum of spreads and commissions. (Advanced traders should pursue that slight difference.)

Other trading conditions,

HFM supports swap-free for almost all accounts

This is a great advantage.

Swap-free further reduces costs, as negative swaps can gradually eat into profits if a position is held for multiple days.

*Swap-free conditions are comprehensively determined and applied based on various factors such as trading lots and holding periods.

Extensive tools and educational content

- Free VPS services needed to start trading

- Seminars and other educational content

- Provision of tools for market analysis such as Autochartist

You can receive a wide range of services, such as Compared to other companies, we have more content in this area, and we believe that there are many opportunities to help you trade.

HF Copy Account

Simply open a copy account account to copy other traders' trades to your own account.

Even if you are not good at developing your own trading strategy, you can still trade with the help of a good trader.

If you have a great trade idea, you can also become a strategy provider and deliver signals.

Safety and Reliability

HFM is licensed in several countries and complies with strict financial regulations. In addition, client funds are segregated from corporate funds, guaranteeing a high level of security.

summary

In this article, we have explained how important it is to choose the right brokerage firm. Please refer to this article to find the brokerage firm that is right for you.

MT5 Usage Guide

![MT5 Usage Guide [A must-read for beginners] Thorough comparison of recommended FX brokerages!](https://i0.wp.com/smart-trading-strategy.com/wp-content/uploads/2023/12/2023-12-06-22.25.28.jpg?fit=300%2C171&ssl=1)

![MT5 Usage Guide [Must Read for Beginners] Flow of Opening a FX Account (HFM)](https://i0.wp.com/smart-trading-strategy.com/wp-content/uploads/2023/12/logo-500x250-1.jpg?fit=300%2C150&ssl=1)